Jul 01, · If you pay the premiums and your business is not the beneficiary of the plan, you can deduct them. But if your business is a beneficiary or receives some sort of indirect benefit if the employee dies, you can’t deduct the premium payments. 7. Political Donations. You can get a write-off if your business donates to a registered (c)3 charity When you are starting out, your business plan can help you secure financing and investment. But your business plan does more than tell others what your plans are. A good business plan can help you test the feasibility of your new business idea, set operational and financial objectives, and make sure your business is manageable and effective While current business owners may think they no longer need a business plan, a business plan can be of immense benefit if used properly throughout the life of a business. Not only should you have a business plan when you apply for a loan, you should have a business plan to set future goals and to plan for contingencies

How To Write A Business Plan | blogger.com

The IRS is fairly generous when it comes to tax deductions for small businesses. As a general rule, who can help you write a business plan, a business can write off any ordinary and necessary expense it incurs. There are, however, some notable exceptions to that rule.

These eight expenses seem like legitimate deductions — but can be difficult or impossible to write off. Business gifts are deductible — but to a very limited extent. If you travel for business using your own vehicle, feel free to deduct the mileage at the IRS standard rate, which is currently To account for this, you need to subtract the length of your commute if you visit a client site instead of your place of work.

For example, say your office is a mile round trip from your house and instead you go straight from your home to a client site for the day. If you take a client out to lunch, you can deduct half of the cost as meals and entertainment expense.

If you pay the premiums and your business is not the beneficiary of the plan, you can deduct them. You can get a write-off if your business donates to a registered c 3 charity. You cannot, however, deduct donations made to a political organization or a political candidate.

You use who can help you write a business plan cell phone for work calls, who can help you write a business plan, so the bill is deductible, right? Not necessarily. Thompson Tax and Accounting [PDF] explains that cell phones are considered to be listed property by the IRS and require some extra legwork to deduct.

Phones, along with computers and cars, are items that often have both a business and personal use. You can only write off the business portion of the expense, so you need to calculate what percentage of calls were for business and only deduct that percentage of the expense. This article currently has 3 ratings with an average of 4. Resource Center.

Read eight difficult business expense write offs. Gifts for Customers Business gifts are deductible — but to a very limited extent. Commute Costs If you travel for business using your own vehicle, feel free to deduct the mileage at the IRS standard rate, which is currently Eating Out If you take a client out to lunch, you can deduct half of the cost as meals and entertainment expense. Political Donations You can get a write-off if your business donates to a registered c 3 charity.

Cell Phone Expenses You use your cell phone for work calls, so the bill is deductible, right? Facebook Twitter LinkedIn Messenger.

How To Write A Business Plan That Works

, time: 8:24How to Write a Business Plan for Your Startup

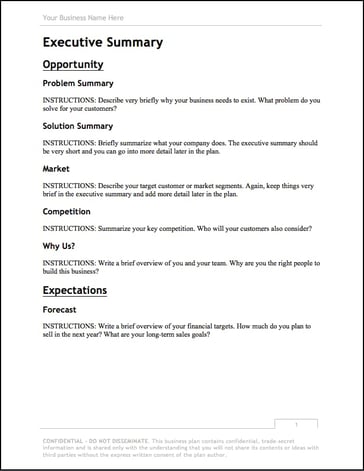

Use this free template to help you write a great plan for launching your new business. A business plan helps you set goals for your business, and plan how you’re going to reach them. When you’re starting out it’s a good idea to do a full and thorough business plan Nov 30, · This information will help you explain your differentiation in the business plan. 5. Dig Into the Numbers. The primary purpose of the financial plan, says Phil Santoro, co-founder of startup studio Wilbur Labs, is to document how much money you need to start the business, and how or when the business will generate revenue and profit While current business owners may think they no longer need a business plan, a business plan can be of immense benefit if used properly throughout the life of a business. Not only should you have a business plan when you apply for a loan, you should have a business plan to set future goals and to plan for contingencies

No comments:

Post a Comment